Improve your Revenue Per Employee

How to Improve Your Revenue Per Employee: Proven Strategies and Contract Management Solutions

Revenue per employee (RPE) is a core business metric that measures how much revenue each full-time equivalent generates over a given period, and improving it directly supports profitability and scalable growth. This article explains what RPE is, how to calculate it, and why it matters for SaaS and services businesses, providing practical steps to improve employee productivity and operational efficiency. Many firms overlook contract management as a lever for RPE, but weak contract lifecycle processes drive revenue leakage, consume employee hours and create compliance risk; we will introduce Contrax as a targeted solution that can help address these issues. You will learn how to calculate RPE with worked examples and industry benchmarks, tactical strategies to increase RPE, the mechanisms by which contract management affects per-employee revenue, and how Contrax maps specific features to measurable RPE improvements. The guide closes with measurement frameworks and advanced concepts for building revenue resilience through contract policy and automation, giving you a clear roadmap to improve RPE while signalling where Contrax can accelerate outcomes.

What Is Revenue Per Employee and How Is It Calculated?

Revenue per employee is a straightforward metric defined as total revenue divided by total headcount (typically FTEs) for a specific period, and it quantifies the average revenue contribution of each employee. This metric works because it links top-line performance to workforce scale, revealing productivity, pricing efficiency and operational leverage; executives use it to compare units, benchmark growth and prioritise investments. Understanding how to calculate RPE correctly requires clarity on revenue scope and headcount definition, which in turn affects benchmarking and interpretation. Below we explain the calculation and provide industry benchmarks that highlight typical ranges for SaaS and services firms, which helps set realistic targets for improvement.

How Do You Calculate Revenue Per Employee?

To calculate revenue per employee, divide the organisation's total revenue for a period by the number of full-time equivalent employees in that same period, ensuring consistency in units and timeframes. For example, a SaaS company with annual recurring revenue (ARR) of £6,000,000 and 60 FTEs has an RPE of £100,000 per employee; by contrast, a services firm with £3,000,000 revenue and 50 FTEs has an RPE of £60,000 per employee, reflecting different business models and capital intensity. Common pitfalls include inconsistent headcount definitions (contractors vs FTEs), seasonal staff spikes and mixing revenue periods; standardise on FTEs and the same reporting window to avoid distortion. Regular cadence—monthly tracking for fast-growth firms or quarterly for stable businesses—improves trend analysis and helps link interventions to RPE movement, which sets up the benchmarking discussion that follows.

What Are Industry Benchmarks for Revenue Per Employee in SaaS and Services?

Benchmarks vary by model: SaaS companies typically show higher RPE due to recurring revenue and scalable gross margins, while services businesses often exhibit lower RPE because revenue scales with headcount and utilisation rates. A practical benchmark range for mid-market SaaS businesses might centre between £80,000 and £200,000 per employee depending on ARR per account and automation level, whereas services firms commonly range from £40,000 to £100,000 per employee influenced by billable utilisation and pricing. Drivers of variance include pricing strategy, customer concentration, product-led growth and the degree of automation in revenue processes; use these factors when interpreting benchmarks rather than rigid thresholds. Benchmarking helps identify whether RPE improvement requires productivity enhancements, pricing changes or operational redesign, leading into the actionable strategies that can raise RPE.

These benchmark ranges provide directional goals and emphasise that lifting RPE usually requires addressing both revenue-side levers and efficiency-side levers, which is why the next section focuses on practical strategies.

Which Strategies Effectively Increase Revenue Per Employee?

Improving RPE combines boosting revenue per customer and reducing non-revenue time per employee through productivity, process redesign and targeted investment in skills and tools. The mechanism is simple: increase the numerator (revenue) or reduce the denominator (headcount time spent on non-value tasks) while preserving product quality and customer satisfaction. Strategic initiatives include process automation, pricing optimisation, upsell and renewal focus, and workforce enablement—each contributing measurable RPE gains when implemented with clear KPIs. Below are practical, high-impact strategies you can deploy immediately, with recommended next steps to operationalise them.

The following strategies are proven to impact revenue per employee through direct revenue increases or time savings:

Automate Repetitive Processes: Reduce administrative tasks such as manual contract handling to free employee time for revenue-generating activity.

Improve Pricing and Packaging: Optimise product tiers and discounts to increase average revenue per customer without proportional headcount growth.

Focus on Renewals and Upsells: Systematic renewal management and targeted upsell campaigns increase retained revenue with existing teams.

These strategies are complementary: automation reduces wasted time, pricing lifts average revenue per customer, and retention-focused activity extracts more value from existing accounts; together they create sustainable RPE improvement.

How Can You Boost Employee Productivity to Improve Revenue Per Employee?

Boosting productivity begins by identifying non-value tasks that absorb employee hours and replacing them with automation, clearer roles and streamlined workflows. Practical tactics include removing manual approvals, centralising information to avoid duplication, and introducing approval workflows that route tasks to the right person at the right time—this reduces cycle time and cognitive load. Measurement should focus on time-to-value metrics such as hours spent on contract administration per month and the resulting freed capacity that can be redeployed to sales, customer success or product work. Improving productivity is a prerequisite to scaling revenue without equivalent headcount increases, and that naturally leads into how training accelerates ramp and output.

How Does Employee Training and Development Impact Revenue Per Employee?

Targeted training shortens ramp time and increases average deal size by equipping staff with product knowledge, sales techniques and contract literacy that directly affect revenue generation. For example, training sales on contract clauses and renewal negotiation can improve conversion and retention rates, while upskilling operations on automation tools reduces errors and throughput time. Measure training ROI by comparing pre- and post-training RPE over defined cohorts and by tracking intermediate metrics such as time-to-first-sale and average contract value. Training complements process and technology changes by ensuring teams use tools effectively, which sets up the importance of contract management tooling in the next section.

How Does Contract Management Drive Revenue Per Employee Growth?

Contract management drives RPE growth by preventing revenue leakage, reducing time spent on manual contract tasks and ensuring compliance that protects net revenue; weak CLM practices tend to erode both revenue and employee productivity. Mechanisms include missed renewals reducing retained revenue, rework from inconsistent contract templates consuming legal and sales time, and delayed revenue recognition due to slow approvals—all of which depress RPE. Analysing contract workflows reveals meronyms such as renewal alerts, approval workflows and central repositories that, when optimised, unlock employee time and preserve revenue. A vendor-agnostic look at these pain points clarifies why contract lifecycle automation is a high-return intervention and helps introduce how contract platforms like Contrax target these exact mechanisms.

Inefficient contract management produces several hidden costs that directly affect revenue per employee:

Missed Renewals: Lost recurring revenue when renewal dates are overlooked, reducing overall revenue per head.

Administrative Overhead: Significant staff hours devoted to locating, amending and re-authoring contracts instead of revenue work.

Compliance and Penalty Risk: Financial exposure from non-compliant terms or missed obligations that reduces net revenue.

By mapping these costs to employee time and revenue impact, organisations can prioritise CLM interventions that yield measurable RPE improvements, transitioning into the value of automation for renewals and compliance next.

How Does Automating Contract Renewals and Compliance Prevent Revenue Leakage?

Automation prevents revenue leakage by creating systematic renewal alerts, standardising renewal terms and enabling straightforward approval workflows that capture renewals before they lapse. A before/after scenario shows that automated renewal alerts can reduce missed renewals by a significant percentage, preserving recurring revenue without adding staff headcount; automation also lowers error rates from manual edits and accelerates commercial response times. Compliance checks embedded in workflows reduce the likelihood of penalty events and ensure consistent application of revenue-protecting clauses, which in turn supports predictable revenue per employee. These automation mechanisms set up the need for a focused CLM platform and guide the discussion toward Contrax as a tailored solution for SaaS and services businesses.

The table shows how specific CLM capabilities map to RPE-relevant outcomes, and this mapping explains why a purpose-built CLM like Contrax can deliver measurable results, which we examine in the next section.

How Can Contrax Optimize Contract Management to Maximise Revenue Per Employee?

Contrax is a multi-lingual customer contract management SaaS solution designed to transform contract management in 90 days and optimise customer contract management for SaaS or services businesses. By centralising contracts, automating renewals and providing recommendations on contract value distribution and renewal dates, Contrax targets the exact levers that protect revenue and reduce administrative burden. Its value proposition includes seamless lifecycle management to unlock efficiency and compliance, helping businesses avoid hidden costs associated with weak contract management while supporting measurable RPE improvements. Below we map Contrax features directly to RPE impact using an Entity–Attribute–Value table to make the feature→metric relationship explicit.

This EAV mapping shows how automation and visibility reduce non-revenue work and protect revenue, thereby increasing effective revenue per employee when deployed across sales and customer success teams.

Which Contrax Features Streamline Contract Workflows and Boost Employee Efficiency?

Core Contrax features such as template standardisation, workflow automation and renewal scheduling directly streamline work by minimising manual edits, routing approvals automatically and surfacing upcoming renewals before they become lapses. These features shorten time-to-contract and reduce legal and administrative touchpoints, which converts into hours that staff can spend on acquisition, retention and product work—activities that increase RPE. Estimates of time saved per feature will vary by organisation, but the principle is consistent: reducing repetitive tasks by automation yields linear gains in revenue capacity per employee. Implementing these features typically follows a short deployment rhythm aligned with Contrax’s "transform in 90 days" UVP.

Contrax also enhances productivity through integrations and standard templates that eliminate repetitive formatting and clause negotiation; this reduces cognitive load for teams and lowers the per-contract time cost, setting up the next discussion about visibility and control.

How Does Contrax Enhance Visibility and Control Across Customer Contracts?

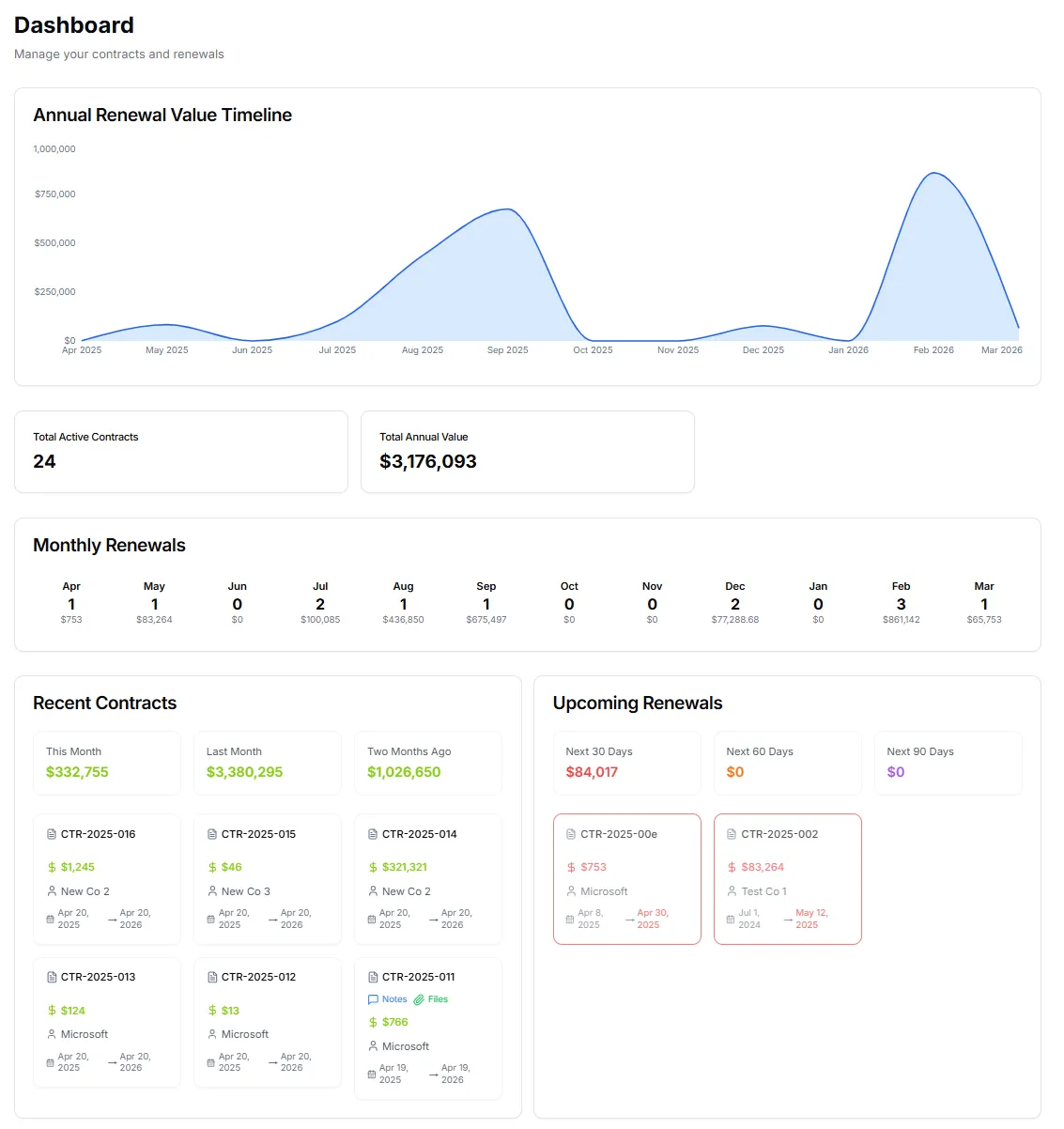

Contrax provides dashboards and central reporting that surface renewal pipelines, customer concentration, and contract value distribution, enabling managers to prioritise renewal and upsell opportunities that maximise revenue per employee. Visibility reduces decision latency: when account managers can see imminent renewals and contract values, they act earlier and more effectively, increasing retention and revenue without headcount growth. Control through role-based access and audit trails also reduces compliance risks that can erode net revenue, while multi-lingual support ensures global customer contracts are managed consistently. This transparency and control are essential for converting contract data into actionable revenue opportunities, which leads naturally to how to measure and report these improvements.

How Do You Measure and Track Revenue Per Employee Improvements with Contrax?

Measuring RPE improvements requires aligning financial and operational data—revenue figures, headcount/FTE counts and contract-level KPIs like renewal rate, time-to-renewal and revenue retained—and using a single platform for attribution. Contrax surfaces relevant KPIs and provides dashboards and exports that tie contract events (renewal, amendment, upsell) to revenue outcomes, making attribution clearer for RPE calculation. A metric table below shows how key KPIs map to data sources and how Contrax reports them so leaders can monitor RPE movement over time and adapt interventions. Establishing a baseline and reviewing these KPIs at regular cadence ensures that improvements are real, attributable and sustainable.

This mapping clarifies which datasets feed RPE measurement and how visibility in Contrax supports ongoing monitoring and accountability, and it paves the way for real-world examples and projections.

What Key Metrics and Reporting Tools Does Contrax Provide for RPE Monitoring?

Contrax provides dashboards for renewal pipelines, contract value distribution, and time-based workflow analytics that make it easier to track renewal rate, time-to-contract and revenue retained—metrics that directly inform RPE. These tools collect data from contract events, user activity and configured attributes (for example, renewal dates and clause flags) enabling leaders to segment by product, region or customer to identify high-impact opportunities. By exporting reports and integrating with finance/HR systems, teams can calculate RPE consistently and attribute improvements to specific CLM changes. Regular review cadence—monthly for fast-moving portfolios, quarterly for stable clients—ensures the measurement loop drives operational adjustments.

What Are Real-World Examples of Revenue Per Employee Growth Using Contrax?

Representative scenarios show measurable uplifts: a SaaS business that reduced missed renewals through automated alerts can expect improved retention that translates directly into higher RPE within a single renewal cycle, while a services firm that halves contract admin time enables consultants to spend more hours on billable work, lifting revenue per head. Using conservative estimates—reducing contract admin by 20% and improving renewal retention by 5%—organisations can model RPE uplift and present a clear ROI case for CLM investment. Contrax’s "transform in 90 days" messaging indicates a rapid implementation path, which supports shorter attribution windows for measuring RPE change; teams should document baseline metrics and track outcomes across the initial 90-day period to validate impact.

What Are Advanced Concepts for Building Revenue Resilience Through Contract Management?

Advanced contract strategies focus on portfolio-level controls—strategic contract value distribution, customer concentration management and predictive lifecycle automation—to build revenue resilience that protects RPE against churn and market shifts. These concepts combine policy (contract terms and renewal cadence), analytics (predictive modelling for churn and upsell) and integration (CRM/ERP connections) to create an adaptive revenue engine that scales without linear headcount increases. Emerging trends like AI-assisted contract analytics enable early identification of at-risk renewals and suggest negotiation levers, contributing to sustained RPE growth. The strategic view shifts from tactical efficiency to durable revenue resilience, which is the final topic before practical roadmaps for adoption.

Strategic contract value distribution involves deliberate policy choices to avoid customer concentration and smooth renewal timing across the portfolio:

Diversify Contract Value: Spread revenue so no single customer or renewal date dominates the portfolio.

Stagger Renewal Cadence: Avoid clustering renewals that create volatile revenue periods and strain teams.

Adjust Terms to Protect Lifetime Value: Use contractual levers to increase predictability and retention.

How Does Strategic Contract Value Distribution Support Sustainable Revenue Per Employee?

Strategic distribution mitigates concentration risk by ensuring that revenue is not overly dependent on a small set of contracts, which stabilises average revenue per employee and reduces volatility in headcount planning. Tactics include adjusting renewal terms, negotiating phased renewals and targeting upsells across a broader customer base to smooth revenue distribution. By managing contract value intentionally, companies protect RPE from sudden losses and enable predictable workforce utilisation, which supports long-term hiring and compensation decisions. These portfolio-level policies are most effective when combined with lifecycle automation to execute at scale, as discussed next.

How Can Businesses Use Contract Lifecycle Automation to Future-Proof Revenue Per Employee?

Contract lifecycle automation extends beyond renewals to include predictive analytics, clause standardisation and CRM/ERP integrations that enable proactive retention and upsell strategies driven by data. A staged roadmap begins with centralising contracts and automating renewals, then adds reporting and predictive models, and finally integrates contract signals into CRM workflows for automated account actions. Benefits include faster decision cycles, improved attribution for RPE metrics and the ability to scale revenue actions without proportional staffing increases. For organisations ready to adopt a CLM platform, tools that combine automation, visibility and analytics deliver the most robust path to future-proofing revenue per employee, and for those seeking such a solution, Contrax offers targeted capabilities and a clear implementation promise.

As you evaluate options, remember that contract management interventions are high-leverage: they both protect existing revenue and free employee time for growth activities. For organisations aiming to convert contract efficiency into measurable revenue per employee gains, exploring a specialised CLM solution that aligns with the strategies outlined here is the logical next step—SystemAssure ITSM Ltd.'s Contrax is positioned as a practical option for SaaS and services firms seeking rapid transformation.

For hands-on measurement and implementation, set an initial 90-day improvement plan, baseline RPE and contract KPIs, and prioritise automation of renewals and reporting; teams that follow this roadmap can expect clearer attribution and steady uplift in revenue per employee while maintaining compliance and reducing hidden costs.

Conclusion

Improving revenue per employee is achievable through strategic contract management and targeted automation, which can significantly enhance productivity and profitability. By leveraging tools like Contrax, businesses can streamline workflows, reduce administrative burdens, and ultimately protect and grow their revenue streams. Embrace these insights to transform your operational efficiency and drive measurable results. Discover how our solutions can help you optimise your contract management today.