Contrax: Improve Contract Management & Protect Your Revenue

Stop Losing Revenue: Rethinking Contract Management

Let’s be honest—most businesses are haemorrhaging money through the cracks in their contract management processes. It’s rarely intentional. You sign a deal, file away the document, and move on to the next pressing task. But over months and years, missed milestones, forgotten renewal dates, and unclear terms can quietly erode your profits. If you’re still relying on spreadsheets or email chains to track your agreements, you might as well be leaving wads of cash on the table.

In this post, we’re diving straight into the heart of contract management, focusing especially on customer contract management. You’ll see why clinging to outdated methods could be costing you far more than you realise and, perhaps more importantly, how you can turn things around to protect your bottom line and build lasting success.

Why Contract Management Matters More Than You Think

Most leaders think of contract management as a box-ticking exercise: essential, perhaps, but hardly glamorous. The reality is, your contracts are the backbone of every revenue stream.

Every customer relationship, every recurring fee, every upsell it’s all governed by the agreements you forge. A single missed clause can lead to revenue leakage, disputes, or even the total loss of a customer. If you want to stop missing out on profits, it’s time to stop treating contract management as an afterthought.

The Real Cost of Outdated Contract Management

Let’s put some numbers on it. According to World Commerce & Contracting, poor contract management can erode up to 9% of a company’s annual revenue. For a business turning over £10 million, that’s £900,000 disappearing into thin air.

How does this happen? Here’s a taste:

Missed renewal opportunities: Contracts auto-renew without renegotiation, leaving you locked at unfavourable terms.

Unbilled services: Promised extras or additional work, never properly invoiced.

Delayed payments: Customers exploit vague payment terms or lack of reminders.

Scope creep: Ambiguous statements of work lead to delivering more than you’re paid for.

For growing companies, these issues multiply quickly. Suddenly, you’re not just missing out on profit—you’re risking the very relationships keeping your business afloat.

What’s Wrong with the Traditional Approach?

Step into any office, and you’ll probably find some version of this system: a dusty filing cabinet, a few shared spreadsheets, and a desperate search through inboxes whenever someone asks, “Do we have a contract with them?”

While this might seem manageable when you have five clients, it falls apart once you scale. Here’s why:

1. Lack of Visibility

You can’t manage what you can’t see. If your contracts are scattered across folders or buried in emails, you’ve got no hope of tracking expiries, obligations, or renewal dates.

Real-world example:

A Midlands-based marketing agency once lost a major client because they failed to notice a termination clause buried on page 14 of an old agreement. By the time they realised, the client had already switched to a competitor—no discussion, no chance to salvage the relationship.

2. No Consistent Process

Without a standard approach, every contract is a new adventure. Some might include robust payment terms, others vague promises. This inconsistency leads to confusion, disputes, and lost revenue.

Case study:

A software provider in Manchester discovered that half their contracts didn’t include clear escalation clauses for overdue payments. When several customers fell behind, the company had no legal recourse and ended up writing off tens of thousands in bad debt.

3. Manual Tracking is a Recipe for Mistakes

Spreadsheets are brilliant for many things, but tracking contract obligations isn’t one of them. Human error creeps in: missed reminders, typos, outdated spreadsheets it’s all too easy to let something slip.

Scenario:

An IT consultancy in London relied on a single administrator to update a master spreadsheet of contracts. When she went on maternity leave, nobody else knew how to maintain it. Several contracts auto-renewed at old pricing, costing the firm thousands in lost margin.

Customer Contract Management: The Heart of Revenue Protection

Most businesses put a lot of energy into winning new customers. But keeping that revenue secure, and making sure your agreements actually deliver what you expect, is just as critical.

Customer contract management is about more than storing documents. It’s about creating a system that ensures every contract is:

Easy to find and review

Monitored for key dates, obligations, and risks

Aligned with your broader business goals

Here’s what robust customer contract management looks like in practice.

1. Centralised Repository

All contracts in one place—searchable, secure, and accessible to the right people. No more digging through emails or chasing colleagues for copies.

Practical tip:

Use a secure cloud-based platform with role-based access. This keeps sensitive information protected but ensures anyone who needs to check a contract can do so quickly.

2. Automated Alerts for Key Dates

Never miss a renewal, milestone, or notice period again. Automated reminders keep you ahead of the curve, giving you time to renegotiate or terminate agreements on your terms.

Example:

A recruitment agency switched to a digital contract management tool that flagged upcoming renewals 60 days in advance. They used this window to negotiate better rates, resulting in a 12% increase in annual revenue from existing clients.

3. Clear Ownership and Accountability

Every contract should have an owner—someone responsible for monitoring compliance and performance. This avoids the classic “I thought you were handling it” problem.

Case study:

A facilities management firm in Bristol assigned a contract manager for each major client. When a dispute arose over service levels, the contract owner quickly produced evidence of compliance, resolving the issue without legal wrangling.

4. Standardised Templates

Using pre-approved templates reduces risk, saves legal costs, and ensures you don’t miss important clauses.

Practical tip:

Work with your legal team to develop a library of templates for different contract types fixed-term, rolling, bespoke services, etc. This keeps negotiations focused and reduces the risk of errors.

How Revenue Slips Through the Cracks: Common Pitfalls in Customer Contract Management

Let’s break down some of the most common ways companies lose money through poor contract management.

1. Unclear Pricing or Scope

If your contract doesn’t lay out exactly what’s included (and what’s not), you’re inviting disputes. Customers may expect extras that weren’t priced, or refuse to pay for add-ons they consider included.

Scenario:

A digital agency delivered several rounds of “minor” website changes for a client, believing they’d be paid for each. The contract was vague, and the client insisted these tweaks were included. The agency spent dozens of hours on unpaid work.

2. Forgetting to Bill for Renewals or Add-Ons

When you fail to track renewals, you risk providing services without payment—or missing the chance to renegotiate improved terms.

Example:

A managed services provider forgot to invoice a client for a software upgrade, as the renewal date slipped by unnoticed. By the time they realised, the client had been using the service for three months, and backdating the invoice soured the relationship.

3. Overlooking Performance Clauses

Many contracts include performance-related payments, rebates, or penalties. If you’re not monitoring these, you could miss out on bonuses—or be hit with penalties you didn’t anticipate.

Case study:

A logistics company failed to meet a delivery SLA for a major retailer. The contract included escalating penalties for repeated failures, but the operations team weren’t aware of these clauses. The penalties wiped out the profit from the contract.

Modern Contract Management: What Does a Better Approach Look Like?

If the problems above sound familiar, you’re not alone. But with the right systems and processes, you can flip contract management from a source of stress to a driver of profit.

Here’s how forward-thinking companies are transforming their approach.

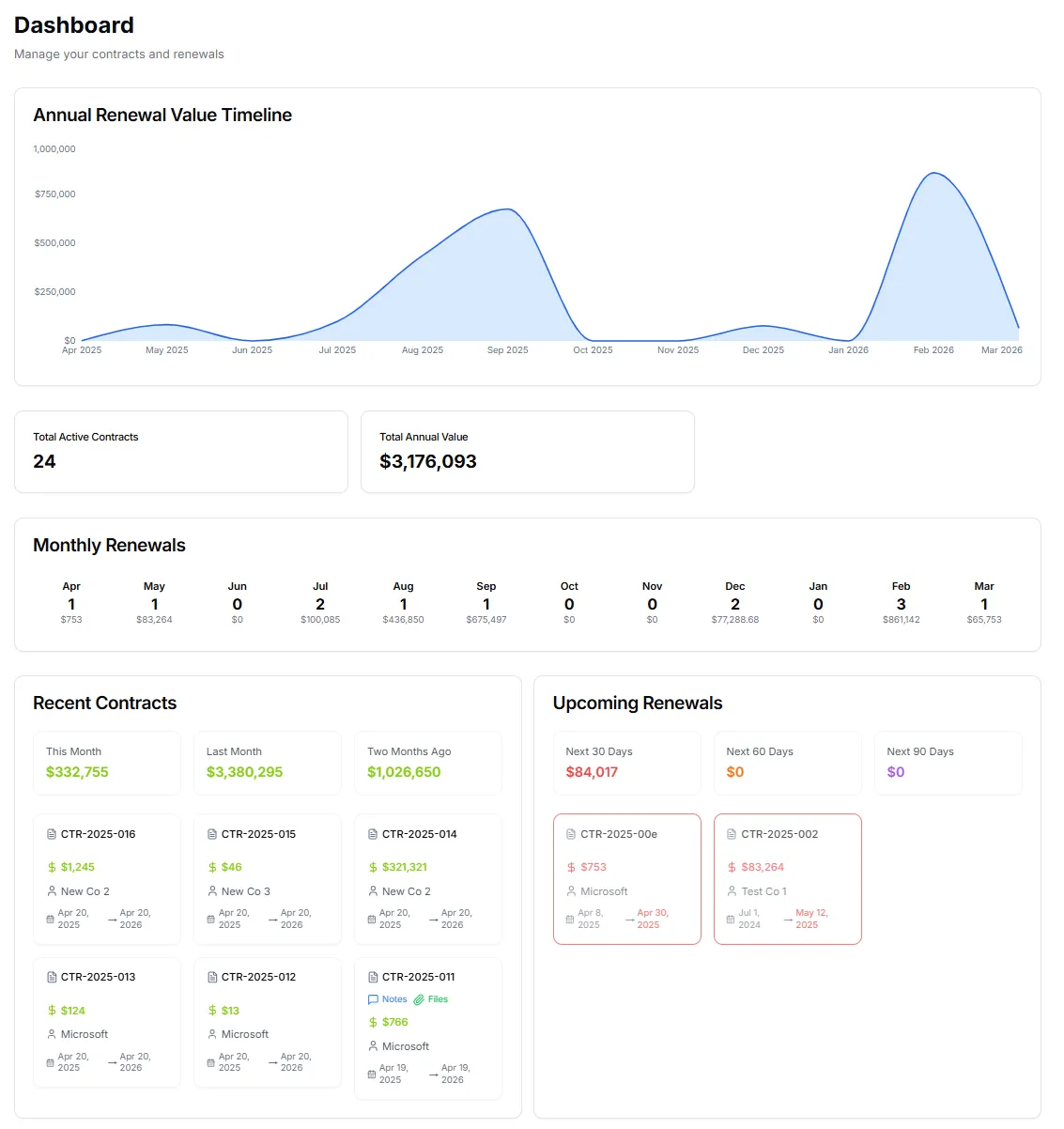

1. Embracing Digital Contract Management Tools

Modern contract management software does more than store documents. It tracks obligations, sends reminders, and provides dashboards so you always know where you stand.

Benefits include:

Visibility: Instantly find any contract, clause, or key date.

Control: Set permissions so only authorised staff can access sensitive information.

Efficiency: Automate routine tasks, freeing up your team to focus on value-add activities.

Reporting: Generate reports on contract status, performance, and risk exposure.

Example:

After implementing a contract management platform, a training company in Leeds reduced contract disputes by 60% simply because everyone could find and reference the same agreement.

2. Regular Contract Reviews

Don’t just “set and forget” your contracts. Build a schedule for regular reviews, checking for upcoming renewals, changes in client needs, or shifts in market pricing.

Practical advice:

Set quarterly reminders to review top client contracts. Look for opportunities to upsell, renegotiate, or clarify terms that are causing confusion.

3. Integrating Contract Management with Sales and Finance

Contracts are where sales promises become financial reality. The best contract management systems integrate with your CRM and billing platforms, so every deal is tracked from signature to payment.

Scenario:

A legal services firm integrated its contract management with its CRM. When a client renewed a retainer, the system automatically updated billing schedules and alerted the finance team—ensuring no revenue slipped through unnoticed.

4. Training and Culture

Technology alone isn’t enough. You need a culture where everyone understands the value of contracts and their role in managing them.

Actionable step:

Run training sessions for sales, account management, and finance teams. Teach them how to spot red flags, escalate issues, and ensure contracts are properly documented and tracked.

Going Beyond the Basics: Advanced Strategies for Contract Management

Once you’ve got the basics sorted, there’s plenty more you can do to squeeze maximum value (and minimum risk) from your customer contracts.

1. Data-Driven Insights

Use contract management data to spot patterns: which customers are consistently late payers? Which contract types lead to disputes? This lets you refine your templates and processes for better outcomes.

Example:

A SaaS company analysed its contract database and found that clients on rolling monthly contracts were much more likely to churn. They switched to longer-term agreements with built-in incentives, improving retention rates by 18%.

2. Proactive Risk Management

Flag contracts with unusual terms, high values, or tight deadlines for extra scrutiny. This helps you head off problems before they become legal disputes.

Scenario:

An engineering consultancy used its contract management system to highlight any project over £250,000. These contracts automatically triggered an internal legal review, catching several risky clauses that would have exposed the firm to costly liabilities.

3. Customer Experience

Believe it or not, good contract management also improves the customer experience. Clear, well-managed agreements build trust and reduce misunderstandings.

Case study:

A facilities services firm found that clients who received regular updates about their contract performance were twice as likely to renew. The transparency created by proactive contract management fostered loyalty and led to more referrals.

Practical Steps: How to Revamp Your Contract Management Today

Ready to stop the revenue drain? Here’s a practical roadmap you can start implementing this quarter.

Step 1: Audit Your Current Contracts

Gather every existing customer contract, digital or paper.

List key dates: start, end, renewal, notice periods.

Identify missing or incomplete agreements.

Step 2: Identify High-Risk Areas

Look for contracts with vague pricing, missing signatures, or unclear obligations.

Prioritise these for review and renegotiation.

Step 3: Choose the Right Tools

Evaluate digital contract management platforms. Look for features like automated alerts, secure access, and integration with your CRM and finance systems.

Consider solutions tailored for your industry.

Step 4: Roll Out Training

Ensure everyone who touches contracts—sales, finance, operations—knows the new process.

Provide easy guides and regular refreshers.

Step 5: Review and Refine

Schedule regular contract management reviews.

Use insights from your system to improve templates, renegotiate unfavourable terms, and spot new opportunities.

Conclusion: Secure Your Profit, Secure Your Future

If you’ve read this far, you already know the risks of outdated contract management. The question isn’t whether you can afford to invest in better systems and processes—but whether you can afford not to.

Every forgotten renewal, every vague clause, every missed billing opportunity chips away at your hard-earned revenue. With a modern approach to contract management—especially customer contract management—you can plug those leaks, resolve disputes before they escalate, and create a foundation for growth that’s both profitable and sustainable.

Don’t wait for the next costly mistake to force your hand. Start rethinking your contract management today and give your business the protection, and the profits, it deserves.

For more practical advice on contract management and digital business transformation, visit Contrax.Cloud